Homework: It is referred to as "self-directed" to get a purpose. With an SDIRA, you happen to be solely responsible for extensively studying and vetting investments.

Better Charges: SDIRAs generally come with increased administrative costs in comparison with other IRAs, as certain elements of the executive method can't be automated.

Opening an SDIRA can give you use of investments Usually unavailable by way of a lender or brokerage agency. Here’s how to start:

SDIRAs in many cases are utilized by fingers-on buyers that are ready to tackle the dangers and duties of choosing and vetting their investments. Self directed IRA accounts can also be great for investors that have specialised awareness in a niche market that they would like to spend money on.

Incorporating funds on to your account. Remember that contributions are issue to once-a-year IRA contribution boundaries established via the IRS.

Increased investment alternatives means you'll be able to diversify your portfolio past shares, bonds, and mutual cash and hedge your portfolio in opposition to marketplace fluctuations and volatility.

Limited Liquidity: A lot of the alternative assets that may be held within an SDIRA, such as real estate property, private fairness, or precious metals, will not be easily liquidated. This can be an issue if you might want to access cash speedily.

Nevertheless there are various Gains related to an SDIRA, it’s not with no its possess downsides. Some of the common explanations why buyers don’t opt for SDIRAs incorporate:

IRAs held at financial institutions and brokerage firms present restricted investment selections to their clientele because they do not have the experience or infrastructure to administer alternative assets.

The tax advantages are what make SDIRAs interesting For several. An SDIRA can be both of those classic or Roth - the account variety you choose will count mostly on your investment and tax tactic. Check out along with your economical advisor or tax advisor for those who’re Uncertain that's ideal for you personally.

Compared with stocks and bonds, alternative assets are frequently more difficult to offer or can have rigid contracts and schedules.

Choice of Investment Choices: Make sure the service provider permits the kinds of alternative investments you’re thinking about, for example housing, precious metals, or personal fairness.

Believe your Buddy could be commencing the following Facebook or Uber? With the SDIRA, you'll be able to put money into triggers that you believe in; and possibly appreciate greater returns.

An SDIRA custodian differs mainly because they have the right employees, skills, and ability to take care of custody of your alternative investments. The initial step in opening a self-directed IRA is to locate a company that's specialised in administering accounts for alternative investments.

Making probably the most of tax-advantaged accounts permits you to preserve more of The cash that you choose to invest and gain. Based on whether or not you end up picking a traditional self-directed IRA or maybe a self-directed Roth IRA, you've the probable for tax-totally free or tax-deferred progress, provided Tax-advantaged metals investment firms specific disorders are met.

A lot of buyers are surprised to discover that applying retirement funds to take a position in alternative assets has actually been possible given that 1974. On the other hand, most brokerage firms and banks give attention to giving publicly traded securities, like shares and bonds, mainly because they lack the infrastructure and experience to handle privately held assets, for instance housing or non-public fairness.

Be in command of the way you increase your retirement portfolio by utilizing your specialised expertise and passions to take a position in assets that in shape using your values. Acquired skills in real-estate or personal equity? Use it to support your retirement planning.

Should you’re searching for a ‘set and ignore’ investing method, an SDIRA most likely isn’t the right preference. Simply because you are in whole Manage over each individual investment manufactured, It really is up to you to perform your own personal homework. Keep in mind, SDIRA custodians usually are not fiduciaries and can't make suggestions about investments.

Complexity and Obligation: With the SDIRA, you have additional Handle over your investments, but You furthermore mght bear much more obligation.

Richard "Little Hercules" Sandrak Then & Now!

Richard "Little Hercules" Sandrak Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Jeremy Miller Then & Now!

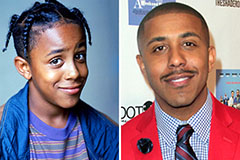

Jeremy Miller Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Soleil Moon Frye Then & Now!

Soleil Moon Frye Then & Now!